I see people asking about foreclosures all of the time. The supposition is that foreclosures are the best deals. Some people think that the banks are so anxious to get the foreclosed home off their books that the homes are priced 10% or more below market value.

I recently publish links to free lists of foreclosed homes in our area on this blog, but that isn’t what today’s post is about.

Here are the four types of sales:

New Construction: This is when you purchase a home from the builder. In our area, these homes typically sell for 3-10% above market value. People value being the first person to live in a new home. There is value to being able to pick out your finishes and live in a super-clean home with that new-home smell. But much like a new car, when you sell, you are selling a “used” home and that 3-10% extra value is gone.

New Construction: This is when you purchase a home from the builder. In our area, these homes typically sell for 3-10% above market value. People value being the first person to live in a new home. There is value to being able to pick out your finishes and live in a super-clean home with that new-home smell. But much like a new car, when you sell, you are selling a “used” home and that 3-10% extra value is gone.

Resale Home: Also known as a traditional sale or “normal” sale. This is when the owner of the home decides to put the home on the open market and sell it. This is essentially the market value of homes in an area.

Resale Home: Also known as a traditional sale or “normal” sale. This is when the owner of the home decides to put the home on the open market and sell it. This is essentially the market value of homes in an area.

Foreclosures: Foreclosed homes are owned by a lien holder (typically a bank or a loan holder like Fannie Mae). Sometimes these homes need work, sometimes not. Unlike resale homes, there is no value to holding the home (renting it out or living there). So, the bank is more motivated than a home owner. Banks typically sell their inventory for 3-5% below market value.

Foreclosures: Foreclosed homes are owned by a lien holder (typically a bank or a loan holder like Fannie Mae). Sometimes these homes need work, sometimes not. Unlike resale homes, there is no value to holding the home (renting it out or living there). So, the bank is more motivated than a home owner. Banks typically sell their inventory for 3-5% below market value.

A quick example since some people confuse the 3-5% discount with a discount for condition of the home. Let’s say that there are two substantially identical homes right next door to each other (same size, condition, room counts, schools, views, finishes, everything). One was foreclosed and is owned by a bank. One is owned by the people who live there. Let’s say that they non-foreclosed home is worth $300,000. In this case, I would expect the foreclosed home to sell for $285,000 to $291,000.

Next example: same two homes. Now the foreclosure home has been abused. It needs paint on the inside. The carpets are torn and the previous owners took all of the appliances with them. Total damages $20,000. In this case, I would expect the foreclosed home to sell for $266,000 to $271,600 (95-97% of {$300,000 – $20,000}).

Next example: same two homes. Now the foreclosure home has been abused. It needs paint on the inside. The carpets are torn and the previous owners took all of the appliances with them. Total damages $20,000. In this case, I would expect the foreclosed home to sell for $266,000 to $271,600 (95-97% of {$300,000 – $20,000}).

Short Sales: A short sale is a home where the owners owe more on the home than its current market value. They want to sell, but don’t have enough money to bring to make the difference to the lender. They are asking for forgiveness of a certain portion of their debt. The owners hire a Realtor and put their home on the market for a price low enough to attract buyers willing to wait for the bank to forgive some of the debt, but high enough for the bank to accept. In our area, about 2/5 of short sales ultimately get approved and closed. (Fairfax County 41%, Loudoun County 45%, PW County 44%)

Short Sales: A short sale is a home where the owners owe more on the home than its current market value. They want to sell, but don’t have enough money to bring to make the difference to the lender. They are asking for forgiveness of a certain portion of their debt. The owners hire a Realtor and put their home on the market for a price low enough to attract buyers willing to wait for the bank to forgive some of the debt, but high enough for the bank to accept. In our area, about 2/5 of short sales ultimately get approved and closed. (Fairfax County 41%, Loudoun County 45%, PW County 44%)

A short sale is not for the impatient. You make an offer and often hear nothing for months. Typically, in two to six months, you will get a response from the bank. The bank may counter your offer, accept it or simply reject it. More than half of these listings never get closed.

A short sale is not for the impatient. You make an offer and often hear nothing for months. Typically, in two to six months, you will get a response from the bank. The bank may counter your offer, accept it or simply reject it. More than half of these listings never get closed.

What do you get for all of this waiting and uncertainty? A great price—typically 12% below market value!

Summary:

In any case, you want a buyer’s agent that can guide you through your transaction from the home search until closing. Contact us for a free buyer’s class to learn about buying in today’s market.

Hose bibs come in two styles. Frost free hose bibs look like this. These hose bibs generally do not need to be winterized. You must remove the garden hose and and splitters attached to the hose bib or it will keep water inside and be subject to freezing. However, if the back of the hose bib is inside your home in an unheated area (garage, crawl-space), you still need to winterize or the pipes can freeze.

Hose bibs come in two styles. Frost free hose bibs look like this. These hose bibs generally do not need to be winterized. You must remove the garden hose and and splitters attached to the hose bib or it will keep water inside and be subject to freezing. However, if the back of the hose bib is inside your home in an unheated area (garage, crawl-space), you still need to winterize or the pipes can freeze.

If you think that you don’t need to do this, take a look at this picture and you may be convinced otherwise. Remember, the froze pipe is inside your home and the water will be inside your home also.

If you think that you don’t need to do this, take a look at this picture and you may be convinced otherwise. Remember, the froze pipe is inside your home and the water will be inside your home also. Home Gain did a survey of over 1000 people who sell their last home. Some interesting stats:

Home Gain did a survey of over 1000 people who sell their last home. Some interesting stats:

The cost of buying a home is different than the price of a home. When you buy a home, there are additional costs (lender’s fees, title insurance, closing fees, recording taxes, home and pest inspections, appraisal). If you pay cash for a home, some of these go away and some are reduced.

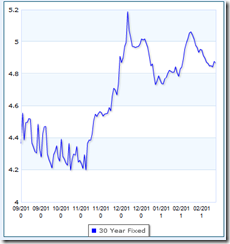

The cost of buying a home is different than the price of a home. When you buy a home, there are additional costs (lender’s fees, title insurance, closing fees, recording taxes, home and pest inspections, appraisal). If you pay cash for a home, some of these go away and some are reduced. So, let’s sum it up. Prices went down 8 1/3% ($300,000 to $275,000). Interest rates only went up 1% (5% to 6%). You saved $2,500 in down payment (10% of the $25,000 difference). You will also save $158.17 in recording tax. Grand total, you paid $9,751.03 more by waiting for the price to go down.

So, let’s sum it up. Prices went down 8 1/3% ($300,000 to $275,000). Interest rates only went up 1% (5% to 6%). You saved $2,500 in down payment (10% of the $25,000 difference). You will also save $158.17 in recording tax. Grand total, you paid $9,751.03 more by waiting for the price to go down. New Construction: This is when you purchase a home from the builder. In our area, these homes typically sell for 3-10% above market value. People value being the first person to live in a new home. There is value to being able to pick out your finishes and live in a super-clean home with that new-home smell. But much like a new car, when you sell, you are selling a “used” home and that 3-10% extra value is gone.

New Construction: This is when you purchase a home from the builder. In our area, these homes typically sell for 3-10% above market value. People value being the first person to live in a new home. There is value to being able to pick out your finishes and live in a super-clean home with that new-home smell. But much like a new car, when you sell, you are selling a “used” home and that 3-10% extra value is gone. Foreclosures: Foreclosed homes are owned by a lien holder (typically a bank or a loan holder like

Foreclosures: Foreclosed homes are owned by a lien holder (typically a bank or a loan holder like  Next example: same two homes. Now the foreclosure home has been abused. It needs paint on the inside. The carpets are torn and the previous owners took all of the appliances with them. Total damages $20,000. In this case, I would expect the foreclosed home to sell for $266,000 to $271,600 (95-97% of {$300,000 – $20,000}).

Next example: same two homes. Now the foreclosure home has been abused. It needs paint on the inside. The carpets are torn and the previous owners took all of the appliances with them. Total damages $20,000. In this case, I would expect the foreclosed home to sell for $266,000 to $271,600 (95-97% of {$300,000 – $20,000}).

A short sale is not for the impatient. You make an offer and often hear nothing for months. Typically, in two to six months, you will get a response from the bank. The bank may counter your offer, accept it or simply reject it. More than half of these listings never get closed.

A short sale is not for the impatient. You make an offer and often hear nothing for months. Typically, in two to six months, you will get a response from the bank. The bank may counter your offer, accept it or simply reject it. More than half of these listings never get closed.